Elevate Your Financial Future

with Expert Tax Services

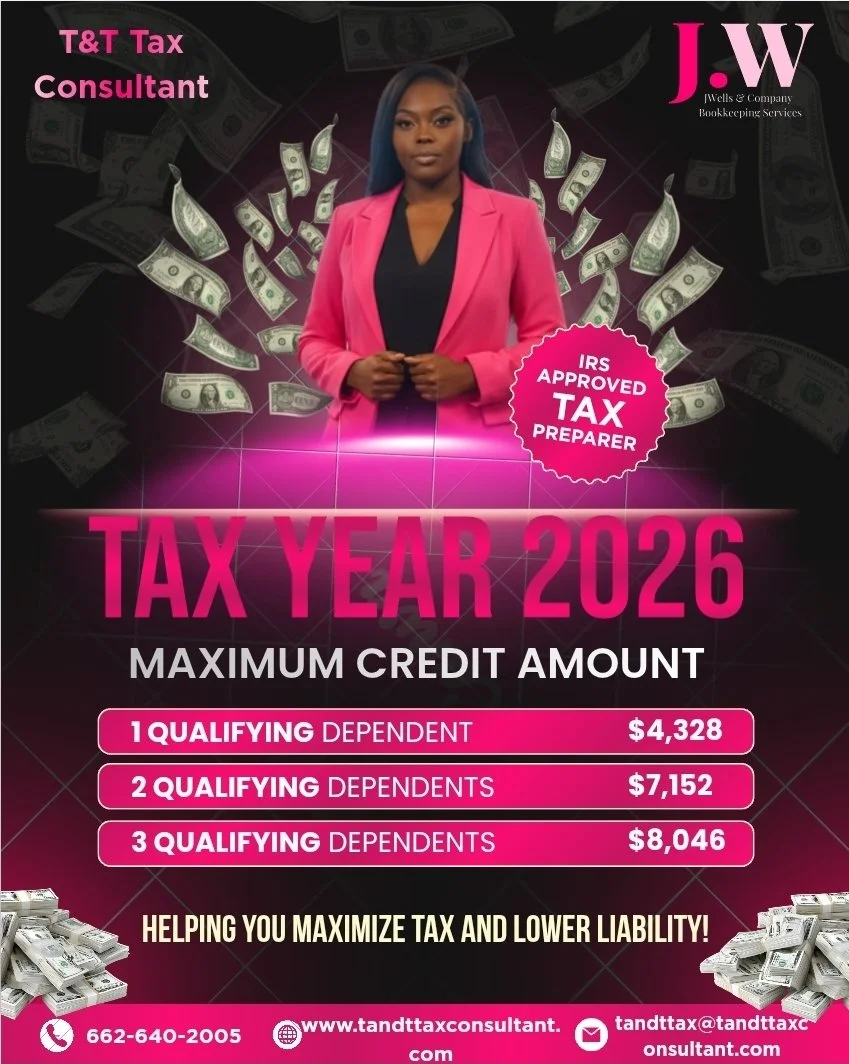

T&T Tax Consultant, LLC — Expert Tax Services Built on Precision and Integrity

At T&T Tax Consultant, LLC, we deliver sophisticated, client-centered tax services that simplify complexity and protect your financial interests. Whether you are an individual, small business owner, or executive with multifaceted investments and compensation, our team applies deep technical knowledge and strategic planning to minimize tax liability, ensure compliance, and support confident decision-making.

Services we offer

“W-2 only" with no dependents means you're filing as single with only one Form W-2 reporting your wages and you are not claiming any dependents. Practical implications:

Filing status: Single. You are not married and not eligible to use Head of Household or Married Filing Jointly/Filing Separately.

Income reporting: All taxable wages, tips, and compensation come from one employer and are reported on a single Form W-2. No other wage income (1099, additional W-2s) is involved.

Dependents: You are claiming zero qualifying children or other dependents, so you cannot claim related exemptions or child tax credits that require dependents.

Standard deduction vs. itemizing: Most singles with a single W-2 use the standard deduction unless you have deductible expenses that exceed it (mortgage interest, large medical expenses, state/local taxes within limits, charitable contributions, etc.).

Tax credits and deductions commonly affected:

You may still qualify for earned income tax credit only if you meet income and other rules (note: credit amounts differ with no dependents).

You may be eligible for the retirement saver's credit, education credits, or the premium tax credit if other eligibility criteria are met.

Withholding and refunds: Your employer’s federal income tax withholding on the W-2 determines estimated payments toward your tax liability. If too much was withheld, you get a refund; if too little, you owe.

Filing forms: Attach the W-2 to your Form 1040 (or e-file the W-2 data). No additional forms for dependents are required.

State tax: State wage reporting and liability follow the same single-wage, no-dependent situation; state rules for deductions and credits may differ.

Services for One W-2 With Dependents

Overview T&T Tax Consultant, LLC provides a focused, efficient tax preparation package for clients with a single W-2 income and one or more dependents. Our service ensures accurate filing, maximizes eligible credits and deductions, and reduces audit risk through professional review.

What we will do

Document review: Examine your W-2, Social Security numbers for you and dependents, prior-year return (if available), and supporting documents (childcare statements, education forms, healthcare coverage, etc.).

Filing status determination: Confirm the most advantageous filing status (single, head of household) based on dependents and living situation.

Dependency and exemption analysis: Verify dependent eligibility and ensure proper claim of qualifying child or qualifying relative rules.

Credits and deductions optimization:

Child Tax Credit and Additional Child Tax Credit

Child and Dependent Care Credit (review of provider information and expenses)

Earned Income Tax Credit (EITC) eligibility check and calculation

Education-related credits or deductions (American Opportunity Credit, Lifetime Learning Credit, if applicable)

Standard vs. itemized deduction evaluation (typically standard for single W‑2 with dependents; we’ll confirm)

Income reporting: Accurately report W-2 wages, retirement contributions, and taxable benefits if present.

Withholding review: Analyze your year-to-date withholding and provide guidance to adjust Form W-4 to avoid under- or over-withholding in future years.

State and local filings: Prepare applicable state (and local) tax returns and identify state-specific credits for dependents.

Direct deposit and e-file: Electronically file federal and state returns and set up direct deposit for refunds.

Audit support and representation: Provide limited audit support—explain notices, prepare responses, and coordinate with the IRS or state tax authorities. Full representation services available for an additional fee.

T&T Tax Consultant, LLC — Tax Services for Self‑Employed Individuals & Small Businesses

Overview We provide comprehensive tax planning, preparation, and advisory services tailored to self‑employed professionals, independent contractors, and small business owners. Our focus is minimizing tax liabilities, ensuring compliance, and structuring your finances for growth and long‑term stability.

Core Services

Tax Planning & Strategy

Ongoing, proactive tax planning to reduce current and future tax burdens.

Entity selection and restructuring advice (sole proprietorship, LLC, S‑corp, C‑corp) to optimize tax outcomes and limit personal liability.

Quarterly estimated tax guidance and cash‑flow planning to avoid penalties and manage tax burdens through the year.

Retirement plan and compensation strategies (SEP IRA, Solo 401(k), SIMPLE IRA) to maximize tax‑advantaged savings.

Tax Preparation & Filing

Accurate preparation and filing of federal and state individual and business tax returns (Forms 1040 Schedule C, 1065, 1120, 1120‑S, and applicable state filings).

Coordination of necessary schedules and forms for depreciation, home office deductions, vehicle and travel expenses, health insurance deductions, and qualified business income (QBI).

Review and reconciliation of books to ensure consistency between tax returns and financial records.

Bookkeeping & Accounting Support

Clean, GAAP‑aware bookkeeping set up or remediation to produce reliable financial statements.

Monthly or quarterly bookkeeping, bank/credit card reconciliation, and categorization of income/expenses for accurate tax reporting.

Profit and loss and balance sheet preparation with actionable insights for better decision‑making.

Estimated Tax & Cash‑Flow Management

Calculation and scheduling of quarterly estimated tax payments for owners and businesses.

Cash flow analysis and tax‑sensitive budgeting to align tax payments with operating needs and reduce surprise liabilities.

Entity Formation & Compliance

Guidance on entity formation appropriate for your business goals and tax position.

Assistance with EIN application, state registrations, annual filings, and compliance requirements.

Audit Support & Representation

Pre‑audit risk assessment and documentation preparation to reduce exposure.

Representation before the IRS and state taxing authorities, including audit defense, correspondence handling, and resolution negotiation.

Specialized Services

Sales tax registration, compliance, and filing support for taxable goods and services.

Multi‑state tax advice for businesses operating in more than one state.

Contractor vs. employee classification reviews and payroll tax compliance.

International tax considerations for U.S. self‑employed individuals with foreign income or foreign entities.

Our company ethos

With a commitment to precision and discretion, our team of tax professionals offers an unparalleled service crafted to navigate the intricacies of your financial landscape.

Discover a bespoke approach that puts you at the forefront of exceptional tax planning and preparation. Learn more